How to Use the SYD Function in Excel

Summary: Explore the capabilities of the SYD function in Microsoft Excel—an essential tool for calculating the sum-of-years' digits depreciation of an asset. This tutorial is tailored for data analysts with expertise in mathematics, finance, and trend analysis.

By mastering this function, you can accurately determine the depreciation amount for an asset using the sum-of-years' digits method.

The SYD function within Excel empowers you to calculate the sum-of-years' digits depreciation of an asset over its useful life. By leveraging this function, you refine your understanding of asset depreciation calculations and optimize your decision-making.

Steps to Use the SYD Function:

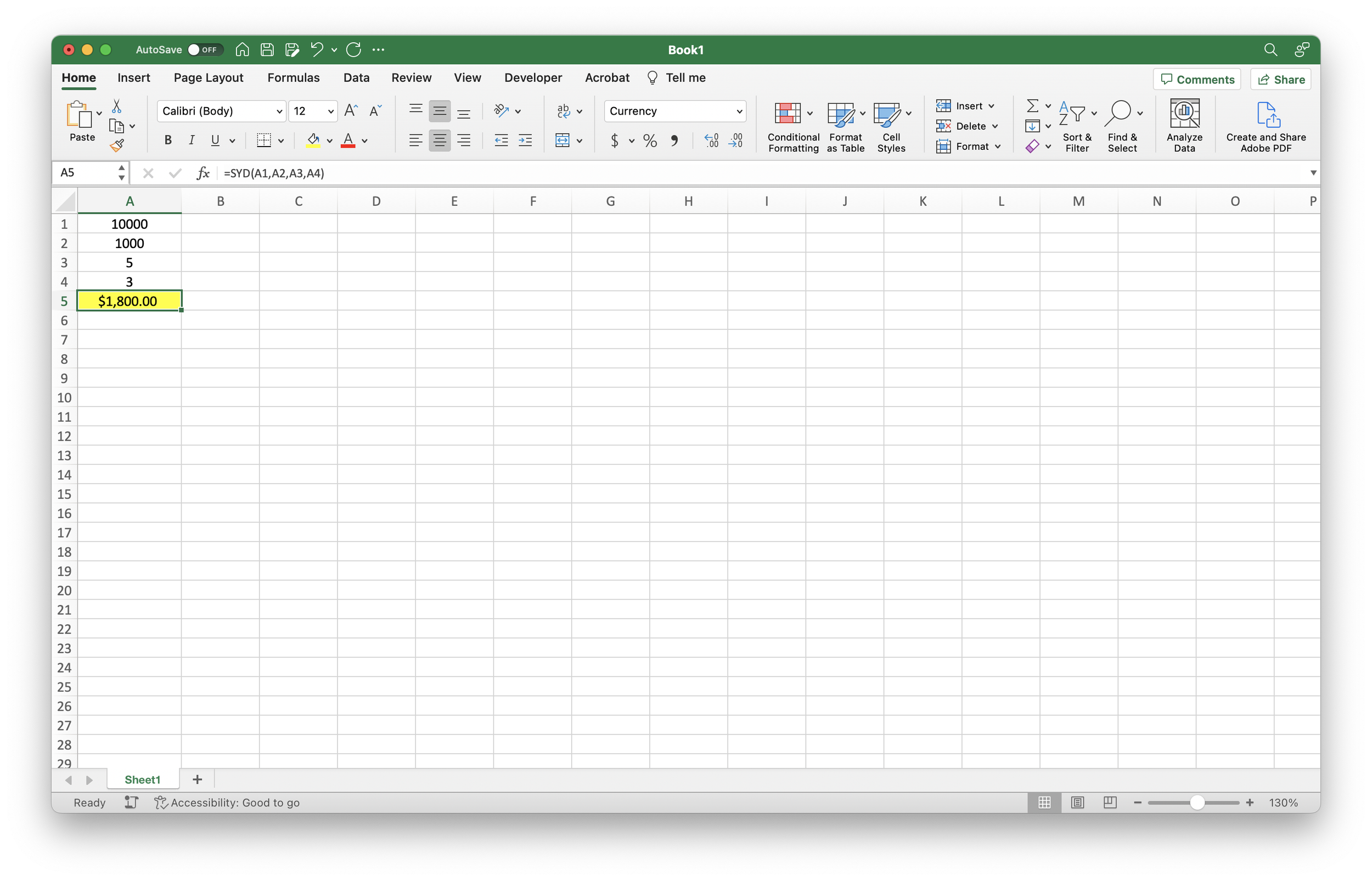

Open Excel: Launch Microsoft Excel on your computer.

Select a Cell: Choose the cell where you intend to display the calculated depreciation amount.

Input the Formula: Enter the following formula into the selected cell:

=SYD(cost, salvage, life, period)

Replace the respective terms with their actual values.

Execute the Formula: Press Enter. The cell will now show the calculated depreciation.

Illustrative Example: For an asset costing $10,000 with a salvage value of $1,000, a 5-year life, and calculating for the third year:

=SYD(10000, 1000, 5, 3)

- Analyzing the Result: As the cell displays the amount, you gain insights into the asset's depreciation.

Conclusion: Mastering the SYD function in Excel provides you with a valuable tool for financial analysis. Enhance your toolkit and decision-making prowess with this function.

Note: The SYD function is available in various Excel versions, including Excel 2016, Excel 2019, and Microsoft 365.